Thomas Isaac’s alternate economic plan revolving around KIIFB has received bouquets and brickbats at the same time. The Finance Minister elucidates on the road to be taken by the Government.

Excerpts from the conversation.

We are currently in a post Budget scenario. How do you assess the financial position of Kerala and do you have any concrete plans to take the economy to a revival path?

As you know, though the Kerala economy, as in the case of other States, is currently on a deceleration path, our performance during 2016-17 was satisfactory with a growth rate of 7%, which was better than the national aggregate. But we are preparing to address this situation and the major plan to kick start the economy is through KIIFB investment, which is expected to be implemented from this year. This year alone, projects worth 30,000 crores, which are all tender ready, are going to be initiated and we foresee an investment to the tune of 50,000 crores in this fiscal which will surely be a major stimulus to the State’s economy. And the second plan is to go in for a major fiscal consolidation in view of the fall in the expected revenue from the Goods and Services Tax (GST). The GST, as you know, is in a fiasco with a lot of glitches still remaining in the execution part. Now we are into the eighth month and the IT backbone for the implementation of the E-way bill is yet to become functional. This is causing a heavy leakage in our coffers since eighty percent of our revenue comes from taxes from outside commodities. But I am still hopeful that Kerala will stand to gain once these hurdles are removed. Now the situation is such that the common man is devoid of the benefits even after the drop in taxes of essential commodities by around 40 to 50 percent. That aside, we are keeping our hopes high though we will have to address a revenue gap say for a year. So we will have to curtail our expenditure for the time being to bring down the revenue deficit. Also we will not hesitate to use the public sector units and SPVs to borrow from the market and make investments in Kerala.

Does it mean that the usage of PSUs for generating additional funds will lead to any sort of disinvestment process in the public sector?

We don’t look forward to a disinvestment strategy at all. You know when we came to power, the total accumulated loss of State-owned industrial units stood at around 200 crores. From that stage we witnessed a sea change in their performance by clocking a praiseworthy profit of 40 plus crores in this fiscal and next year it has been forecasted to go up further. The track record of PSUs always go in for a leap when the Left is in power and this trend is going to be repeated in the coming years also. We see this as a clear and positive message to the private sector players that they can fearlessly invest here and ensure decent profits for their businesses. We look forward for joint ventures with the private investors and the first major step in this direction is the JV with hardware giant Intel, who will be commencing the manufacturing of laptops by setting up a big facility in the State. This will hopefully mark the beginning of a major private investment boom in the State and the Government, in all its capacities, will ensure that the ease of doing business is on track.

The Opposition is skeptical on the Government plan to rely on KIIFB fund for infrastructure investments and the introduction of a Pravasi Chitty project as a fund generator for KIIFB. How do you counter this apprehension?

See, the government has not been secretive about any of the programmes being planned under the KIIFB. Also, the fact that each and every constituency in the State will be benefitted by the investments from this has also not been refuted by any one. We all know that the implementation of the projects planned for the State from the budget surplus will take another two or three decades and by then the cost factor will escalate to alarming levels. This means that a whole new generation will be deprived of the benefits from these projects. Essentially, KIIFB is an attempt to bring private capital to infrastructure projects rather than postponing the projects indefinitely citing financial constraints. We have actually framed a law by which a portion of the tax revenue will be set aside for the projects under KIIFB and the borrowings by it will be backed by securities or guarantees which are approved by the legislature. We have presented these calculations in the Assembly and the Government is implementing only what is enshrined in the law. Therefore this is not going to put any sort of burden on the State in the future. Now, the second part of this question deals with how KIIFB is going to raise money at the lowest rate for a longer period. There are a variety of options to borrow from the market which are approved by SEBI. Another method is to generate fund from the public sector. Here, we have identified KSFE as an ideal choice given the long tradition of trust and goodwill it enjoys among the general public through its chitty business. As we know, the nature of chitty business is that it provides large float and these floats can be easily invested in KIIFB bonds and this will become a major source of fund for it. The idea of launching the ‘Pravasi Chitty’ took shape as a result of the encouraging response we got from the expatriate community for this venture. Suppose a million NRI population invest in this as a savings instrument, this itself will become a major source of fund for KIIFB. Moreover, the safety for money and other attractive benefits compared to bank deposits make this scheme more attractive for NRIs and they will also be contributing to the infrastructure development of the State by becoming part of this project. The whole process of the NRI chitty like payment of installments and auction will be completely online. The software for the same is already ready and the official launch will take place in the mid of this year

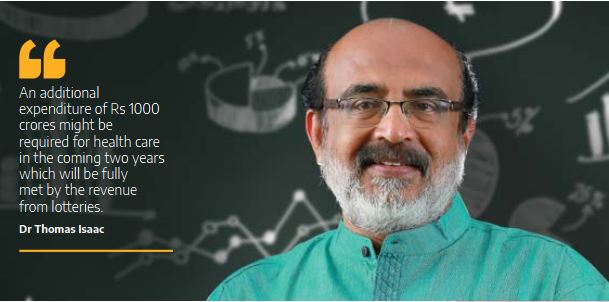

The Kerala State lotteries, which also has a commendable tradition, is celebrating the diamond jubilee. You have also plans to source funds from this area for welfare programmes. Can you elaborate on the same?

See, the only justification to run a lottery is that the earnings from it doesn’t go to private hands but to the public coffer. This is the approach adopted even from the Kautilya times that revenue should go the King or otherwise it will not be encouraged. The Indian Lotteries Act has two objectives. One is to ensure that the revenue go to states and the second one is that it should not become addictive. The Kerala lottery runs within these parameters. About half of the revenue from this goes as prizes, 25 percent as commission to around a lakh of agents, 12 percent as taxes and another 12 percent as government profit. From this year onwards the entire profit of the Government from this will be used to fund a health care programme which might cover at least around fifty percent of the population. All major diseases like cancer, cardiac problems, stroke etc will be covered by this programme which will be implemented through the public health system. An additional expenditure of Rs 1000 crores might be required for this in the coming two years which will be fully met by the revenue from lotteries.

Coming back to KIIFB, has the Government evolved any sort of mechanism to monitor the implementation of the projects under this fund?

The Government departments will not have any role in the utilization of KIIFB funds for any purpose. Instead, we will be having Special Purpose Vehicles created for various sectors who will implement the projects. Now we have certain challenges, the first one being the evolvement of a process to ensure transparency and public oversight and assessing the efficiency of implementation of projects. Like any other PSUs, all KIIFB programmes will be under the strict scrutiny of the legislature and the implementation process and fund allocations will be reported in the Assembly from time to time. The transparency factor will be addressed through this process. Secondly, KIIFB has an independent board consisting of professionals with impeccable track record. We have been fortunate to get the services of a person like Mr. Vinod Rai for this and this willensure that the whole process is taking place in compliance with the rules laid down by the Government. Thirdly, there is a very elaborate IT base system which will thoroughly scrutinize the various projects submitted by the SPVs by subjecting it to a series of vigorous appraisals and viability studies and this mechanism ensures that each and every project being pushed under the KIIFB umbrella posses the minimum qualification for implementation.

How do you rate and analyse the Union Budget, which is also projected as a pre-election budget?

My criticism about the Union budget is that it was very conservative in character and has not addressed the major challenge faced by the country, particularly the deceleration. Also the unilateral cut in the allocation for Centrally sponsored programmes being implemented through the States cannot be justified. For example, the Central allocation for ICDS programme has been reduced drastically which is going to leave a huge army of Anganavaaadi workers and teachers high and dry. Moreover, the budget seems to be messy. They have kept fiscal deficit as 3.5 though the target was 3. But we know that the real fiscal deficit is something near 4. It has been brought down by the sale of shares worth one lakh crore rupees from public sector. But these shares were not bought by ONGC, which in effect reflects as a Government borrowing. There has been a series of announcements, especially the health insurance programme. But nobody has the idea as to how this is going to be implemented and it is also in the dark about the consolidation of resources for the same. Another one is the doubling of farmers’ income. But here also there is no mention about of the source of funds for this and the method of execution. And surprisingly, the Union Budget kept a cruel silence on the excise duty on petroleum products, though every one was expecting a gesture of benevolence from the Centre through a cut in the duty to curtail the skyrocketing prices of petro products.